On a bright and calm Tuesday morning, Jim received his newly minted insurance policy in the mail. As he sat at his kitchen table, the steam from his coffee cup fogged up his glasses, hinting at the warm comfort of a new day. With eager hands, he tore open the envelope, unfolding the stiff papers with a sense of importance and security. His eyes began to dart across the pages, flitting over words like “indemnification,” “subrogation,” and “exclusions.”

On a bright and calm Tuesday morning, Jim received his newly minted insurance policy in the mail. As he sat at his kitchen table, the steam from his coffee cup fogged up his glasses, hinting at the warm comfort of a new day. With eager hands, he tore open the envelope, unfolding the stiff papers with a sense of importance and security. His eyes began to dart across the pages, flitting over words like “indemnification,” “subrogation,” and “exclusions.”

As the morning waned into afternoon, the words on the policy twirled into indecipherable jargon. The sheer complexity of the document, laden with legal parlance and dense clauses, turned his initial comfort into stress and confusion.

***

This all-too-common scenario plays out daily, highlighting the chasm between the insurance industry’s paperwork and the layperson’s understanding. The result is a cascade of disputes, misunderstandings, and a reluctant trudge to the courtroom, where only lawyers seem fluent in the language of these binding agreements.

This difficult-to-read document is one major reason insurance disputes go to court. To help policyholders understand their policies, insurance companies should write their insurance documents in plain English, using simple words and sentences. Readability formulas can help the insurance industry simplify their documents.

The average American reads at an 8th to 9th-grade level; however, most insurance policies require a higher level of comprehension, often post-secondary, according to The National Association of Insurance Commissioners.

1. Every policyholder must understand (and wants to understand) their insurance policies. Using excessive legal terms bewilders and frustrates most policyholders. While it is important insurance policies are formal enough to not look like advertising brochures—they should be informal enough to make for easy reading. The challenge is writing a readable legal document that an average American citizen can read and understand. Insurance experts can revise wordy, long-winded policies by removing difficult words and replacing them with easier ones. They can also divide long sentences into shorter, more digestible sentences.

An online Harris Interactive poll revealed that 87% of drivers who currently have auto insurance said they had read at least part of their auto insurance policies; and 36% of drivers who had read their auto insurance policies found them difficult to understand.

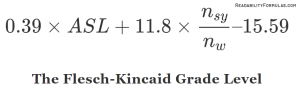

2. The State of Massachusetts incorporated the Flesch Test into their legislation, which forces insurance policies to have a minimum score of 50. In the state of Connecticut, regulation requires policies to avoid “the use of unnecessarily long, complicated, or obscure words, sentences, paragraphs, or constructions.”

Many states are trying to improve consumer-friendly legislation so consumers are fully aware about every clause and sub-clause of a legal document. This idea is derived from the Latin phrase consensus ad idem, which means that parties to a contract understand its subject matter and implications in the same sense.

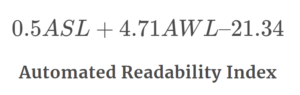

3. The policyholder should know the premium he has to pay, frequency of payments, specific exclusions to the claim, his duties and responsibilities, disclaimers, disclosures, and so on. A difficult-to-read insurance policy frustrates and bewilders most policyholders to understand the policy’s small print. ReadabilityFormulas.com recommends using the Flesch-Kincaid, FORCAST, or FOG Index formulas for insurance documents.

4. Consumers will never buy an insurance product that they find confusing. If the policy lacks cohesion, the prospective consumer is more likely to search for a different insurance company. If you can present the same information in simpler details, you can convince even the most uninterested customers to buy a policy.

Robert Hunter of the Consumer Federation of America stated, “Even policies written in plain English are above the average person’s grade level. There are so many twists and turns in the language that you can read through the whole policy and not understand it.”

5. Making policies easy to read helps customers trust their insurance company. It shows the company is open and honest. For example, GEICO has received positive feedback for using straightforward language in its policies. This transparent approach makes clients feel valued and respected, fostering trust.

6. In some places, the law says that policies must be clear. Using easy language helps insurance companies follow these rules and look responsible. In California, laws require companies to craft insurance documents at a specific reading level. Companies like Allstate comply with these regulations, thereby avoiding legal issues and portraying a responsible image.

7. Clear language helps people who speak English as a second language understand policies better. This means insurance companies can sell to more people. Progressive, for example, offers policies in clear and simple English, making them more accessible to non-native English speakers in various communities. This has expanded their reach in diverse markets.

8. Clear policies mean fewer misunderstandings. This can save time and money by avoiding legal fights. By adopting clear language in their policies, State Farm has reduced disputes with customers. This means fewer legal cases and a smoother relationship with clients.

9. When policies are easy to read, people understand what they’re buying. This means they’ll be happier with what they get. USAA uses straightforward language that allows customers to know exactly what they are purchasing. This has led to increased customer satisfaction and fewer complaints.

10. Many computer and online programs help write clear language. Insurance companies can use these to make sure their documents are easy to read. For instance, Aetna integrated readability software in their drafting process, ensuring consistent clarity across all documents. This technology makes their policies user-friendly and easy to understand.

11. More people are reading their policies on computers and phones. Clear language helps make this easier and keeps customers happy. Nationwide, for example, designed its online policies with readability in mind. This makes it easier for clients to access and understand their documents on various devices, enhancing their online experience.

12. Everyone likes things that are easy to understand. By making policies clear, insurance companies show that they know what customers want today. Liberty Mutual embraced the trend toward clear communication by aligning their policies with customer expectations.

A report by the Plain Language Action and Information Network (PLAIN) suggests that improving the clarity of insurance policies could save the industry up to $75 million annually in customer support costs.

Insurance policies don’t need to confuse customers. By using simple language, companies like GEICO, Allstate, and Progressive are making their policies easier for everyday people. This not only helps customers but also makes good business sense. It leads to more trust, fewer problems, and happier customers. In the end, clear language is a win for everyone. It’s a trend that’s here to stay.